Picture Taylor, a 23-year-old working both a morning shift at a café and evening hours at a call center. Bills and rent show up like clockwork, but with inconsistent pay schedules, Taylor often found it challenging to keep the bank balance above zero. More than once, late deposits led to steep overdraft fees. Visits to a physical bank were practically impossible with such a hectic routine.

Here’s how Chime made things easier: Taylor signed up entirely online—no lines or wait times—and set up direct deposit so that paychecks from both jobs arrived up to two days earlier. Chime’s fee-free overdraft protection provided a helpful safety net during tight weeks, and automatic savings meant spare change went straight into a little nest egg after every purchase. Plus, with everything tracked in one mobile app, Taylor no longer had to stress about hidden fees or scheduling a bank visit. Instead, Taylor could focus on juggling jobs with a little more financial confidence each month.

This post contains affiliate links. If you make a purchase through these links, I may earn a commission at no extra cost to you.

Contents

- 1 What is Chime and How Does It Work?

- 2 Why Are People Using Chime?

- 3 Pros and Cons of Chime

- 4 Should I Use Chime Bank?

- 5 Should I Switch to Chime?

- 6 Should I Open a Chime Account?

- 7 Real Experiences with Today’s Deal Chime Bank

- 8 Getting Started with Chime: What to Expect

- 9 The Future of Digital Banking

- 10 A Final Word on Today’s Deal Chime Bank

What is Chime and How Does It Work?

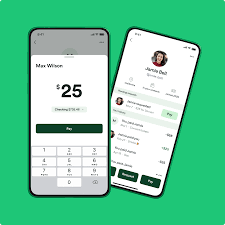

Chime is a digital banking service that aims to simplify your financial life. Its account setup is straightforward, entirely mobile based, and designed for ease of use. I was drawn to its focus on low fees and a range of features that traditional banks often charge for.

Here’s how it works: After downloading the Chime app, you can quickly set up an account without the red tape that sometimes comes with large banks. Once your account is active, you can deposit checks by taking a picture with your smartphone, transfer funds, pay bills, and track your spending through a user friendly interface.

One of the standout features is the automatic savings component. With Chime, a percentage of each deposit can be automatically set aside in a savings account, helping you save without having to think about it every day. The app also offers early direct deposit which means you get paid sooner when your employer sends a digital deposit.

This modern approach means no physical branches, but that doesn’t seem to bother many users who value convenience, quick access, and lower fees.

| Service/Feature | Description | Main Benefit |

|---|---|---|

|

Early Direct Deposit

|

Receive your paycheck up to two days earlier compared to many traditional banks. | Faster Access to Funds |

|

Fee-Free Overdraft

|

Enjoy SpotMe, which allows overdrafts up to $200 without penalty fees. | Avoid Costly Fees |

|

Wide ATM Network

|

Access 60,000+ fee-free ATMs at major retail locations nationwide. | Convenience & Savings |

|

Mobile App

|

Manage accounts, track spending, and deposit checks instantly via the user-friendly app. | On-the-Go Banking |

|

Automatic Savings

|

Save effortlessly by rounding up purchases or setting automatic transfers from each paycheck. | Hands-Free Saving |

|

No Hidden Fees

|

Forget monthly maintenance, minimum balance, or foreign transaction fees. | Less Stress |

|

24/7 Customer Support

|

Friendly support is available anytime through phone, chat, or email. | Peace of Mind |

Why Are People Using Chime?

Many individuals are moving toward digital banking for various reasons. Chime’s list of features appeals to those who want a flexible, cost effective alternative to traditional banks. Below are some reasons why people are choosing Chime:

- The app is very simple, providing a clean and intuitive interface that is easy to navigate.

- No monthly maintenance fees mean more of your money stays in your account.

- Early direct deposit gets your paycheck to you faster than traditional banks.

- No minimum balance requirements, which is great for anyone who wants to avoid penalty fees.

- Automatic savings helps users build financial security over time without manual effort.

- The security measures in place allow for safe online transactions without compromising convenience.

For many, these features represent a change in how they want to manage finances. Users appreciate having more control over decisions related to their money and not being burdened by unnecessary fees or outdated banking methods.

Pros and Cons of Chime

While Chime offers an appealing package, there are both strengths and weaknesses to consider. Weighing these factors can help you decide if Chime is the right fit for you.

Pros:

- Minimal Fees: With no hidden fees, avoiding monthly maintenance fees, and a commitment to low or no overdraft fees in many cases, Chime puts money back in your pocket.

- Early Direct Deposit: Getting your paycheck faster is a big advantage if you need quick access to funds for bills or emergencies.

- User Friendly Interface: The app design is clean and easy to use, even for those not too comfortable with technology.

- Automatic Savings Program: Automatically saving money can be a game changer for building an emergency fund.

- Real Time Notifications: Instant updates on transactions help keep you informed about your spending and balance.

Cons:

- No Physical Branches: For those who prefer face to face service or the ability to deposit cash at a branch, Chime’s digital only model may be limiting.

- Limited Check Cashing Capabilities: If you frequently deal with physical checks, the mobile deposit process isn’t always as quick as getting cash from a teller.

- Customer Service Challenges: Some users have noted that while the app is easy to use, reaching a customer service representative can sometimes be slow.

- Transaction Limitations: Although rare, there can be limits on certain types of transactions which might be inconvenient for some users.

Overall, the benefits of Chime’s digital banking system seem to outweigh the drawbacks for many users, particularly those who mostly handle their banking online and appreciate the cost savings.

Should I Use Chime Bank?

Deciding whether to use Chime depends on your financial habits and what you’re looking for in a banking service. If you are someone who values low fees, quick and easy access to your money, and a modern, mobile driven experience, Chime might be a good match.

In my experience, Chime works well for people who don’t require face to face interaction for everyday banking. It is especially useful if you’re comfortable managing your money through an app and don’t often need to deposit cash. I found that its focus on saving and accessible customer service made it a viable option for those looking to manage everyday expenses without unnecessary costs.

Consider these factors while deciding if Chime is right for you:

- How comfortable are you with digital only banking?

- Do you need services that are available 24 hours a day, seven days a week without waiting in line?

- Would you benefit from features such as automatic savings and early direct deposit?

- Are you looking to cut down on fees that traditional banks tend to impose?

Answering these will help you decide if switching to Chime matches your financial goals and lifestyle. If you’re ready to explore a simpler, more cost-effective way to bank, take the next step and open a Chime account today.

Should I Switch to Chime?

Many people wonder if switching institutions is the right step when a new option like Chime becomes popular. The decision usually comes down to evaluating whether your current bank meets your needs compared to what Chime offers.

For those who are tired of high fees, unexpected charges, or cumbersome service, a switch to Chime might seem appealing. The process is simple; you can open an account directly through the app and start transferring funds. However, there might be a slight learning curve as you get familiar with a new system.

I suggest you think about the following before making a change:

- If your current bank charges fees that eat into your savings, Chime’s fee structure might be a welcome change.

- Examine whether you need a brick and mortar presence or if a digital only platform could meet all your needs.

- Consider the ease of switching accounts. Transferring direct deposits and automatic bill payments should be planned out in advance.

- Reflect on how much time you spend visiting a physical bank. If that’s minimal, digital banking might be your best bet.

The idea is not to rush into a decision based solely on trends. Instead, look at your personal needs and financial habits. For many, the prospect of no monthly fees and improved digital functionality makes switching to Chime a smart move.

Should I Open a Chime Account?

Opening a Chime account is a straightforward process, and several aspects can be appealing if you’re considering trying out a modern bank. If you’re someone who is comfortable handling banking digitally and looking to take advantage of innovative features like automatic savings or early direct deposit, the process is quick and hassle free.

Based on what I’ve seen, here are some reasons you might want to open a Chime account:

- Easy Setup: You can create an account within minutes by downloading the app and following on screen instructions. There’s no need to visit a branch, which means you save time and effort.

- No Hidden Costs: The promise of minimal fees is attractive, particularly for those always mindful of every dollar.

- Helpful Saving Tools: Automatic savings features are designed to help you build a reserve without having to think twice, which I found very beneficial.

- Better Cash Flow: Early access to your direct deposit means you gain faster control of your funds, allowing for a nimble financial response to everyday needs.

If the idea of managing your money securely through a mobile app excites you, then opening a Chime account may be worth considering. It is about choosing a service that fits your lifestyle and offers practical perks without overwhelming you with unnecessary extras.

Real Experiences with Today’s Deal Chime Bank

Personal experiences with digital banking are worth noting. I have spoken with several users who switched to Chime and shared inspiring feedback about how it changed their banking life. These real world experiences highlight that even though the platform is relatively new compared to traditional banks, safety and ease of use are top priorities at Chime.

Here are a few insights gathered from Chime users:

- Many mention how the early direct deposit feature has made monthly budgeting less stressful, particularly during tight deadlines for paying bills.

- Some users appreciate the automatic savings tool, which sets aside a small portion of every deposit, building a reserve that they might otherwise have forgotten.

- Feedback on customer service has been mostly positive. Although responses can sometimes take longer than desired, the overall guidance provided is useful.

- Most importantly, users feel they have more control over their finances without the confusing structure of traditional banking fees.

These experiences indicate that today’s deal on Chime Bank is more than a buzzword. It is a real option for managing money in a way that centers on transparency and ease of use. Individual circumstances vary, so weighing your current banking needs against Chime’s benefits is important when considering this change.

Getting Started with Chime: What to Expect

If you’re tempted to give Chime a try, the process is designed to be both simple and intuitive. I recommend starting by downloading the app on your smartphone and following the easy on screen instructions. You will be guided step by step from creating your account to setting up features like early direct deposit and automatic saving.

Expect a brief waiting period as your account is verified, and then you’ll have access to a dashboard where you can track your spending, manage transfers, and keep up with your savings goals. This digital first approach is aligned with modern expectations for technology and finance. It is a refreshing change that many are welcoming.

If you frequently change your financial habits or need flexibility, Chime can adjust with you. The mobile interface not only makes banking convenient but also teaches you about your spending patterns. Over time, you may find that having such a clear view of your finances helps you make better decisions day by day.

The Future of Digital Banking

As the financial landscape continues to transform, the future of digital banking grows ever more promising. We are witnessing the next stage in banking where traditional limitations are replaced by convenience and speed. Financial institutions are beginning to put a premium on offering services that are not only secure but also flexible enough to cater to a dynamic, tech-savvy audience. This next stage in digital banking is marked by personalized experiences and improved access to financial tools, all available at your fingertips.

New features and updates are constantly being introduced to improve the experience. Customers can now expect faster transactions, more tailored advice, and a user interface that evolves based on usage patterns. Digital banks are also stepping up efforts to make the experience more intuitive by offering tools that help you monitor spending, set and achieve savings goals, and even get insights into your financial habits. These improvements are designed to ensure that users feel empowered and informed about every financial decision they make.

Furthermore, as customer needs change, banks are expected to mix in some variety by offering services that go beyond just smooth transactions. There is a growing focus on community feedback, and many digital banks are now actively asking for input on how to better serve their users. With these advancements, managing your money becomes less about dealing with outdated structures and more about enjoying a streamlined, intelligent experience. This evolution is truly offering a sneak peek into the future of finance.

A Final Word on Today’s Deal Chime Bank

Chime represents a growing trend toward simple, straightforward banking. Built on the idea of reducing the clutter of traditional banks, it offers essential services in a streamlined package. Whether you’re managing everyday expenses, saving a little each month, or seeking a more convenient way to handle your finances, Chime might be a tool worth exploring.

Always remember that choosing a bank should align with your unique financial needs, habits, and comfort level with digital platforms. The decision to use Chime isn’t permanent; many people appreciate the freedom to test the service before fully committing. If you’re curious, there’s no harm in opening an account, trying it out for a while, and then deciding if it fits your lifestyle.

Modern financial services like Chime can be both enlightening and rewarding. They may simplify your life and support your goals in ways that traditional banking might not. With low fees, early direct deposit, and a convenient mobile platform, today’s Chime Bank deal is a good opportunity to rethink how you manage your money.

If you decide to make the switch, be sure to set up your account correctly and explore all the features. Many users discover that, once they adjust, the transition feels natural and delivers lasting benefits. Every step you take is a move toward better financial wellness.

The digital banking scene is evolving, and Chime is a key part of that shift. Its appeal lies in its practicality, ease of access, and focus on modern financial needs. As with any financial decision, consider your personal situation and do your research. Bottom line: finding a service that truly works for you is what matters most. Ready to explore what Chime can do for you?